Insurance Terms

Knowing just a few key terms can help you ask good questions, lead to more productive conversations with your healthcare providers and lower your out-of-pocket costs. This guide is intended to be helpful but it is always best to be familiar with the details of your own plan.

DEDUCTIBLE

The amount of money you pay out of pocket each year before your insurance will begin covering expenses. Deductibles usually start over at the beginning of each calendar year. The deductible may not apply to all services.

Example: If you have a $2,000 deductible, you pay the first $2,000 of your own medical expenses. This is called meeting your deductible. After that, your insurance will pay some of your medical expenses. You may still have to pay a portion of your expenses through co-pays and co-insurance.

CO-PAY

A fixed amount you need to pay for certain medical services, usually at the time of service. Office visits, imaging exams and prescription medicines often require co-pays.

Example: A visit to a medical office or clinic may require a $25 co-pay, while a hospital visit may involve a larger co-pay. Some services require both a co-pay and co-insurance.

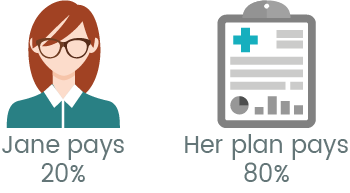

CO-INSURANCE

Co-insurance begins after you've met your deductible and your plan starts paying some of the cost, it is the amount you pay after your insurance has paid its portion of the bill. Co-insurance is calculated as a percentage of the total cost rather than a fixed dollar amount.

Example: You've reached your deductible for the year and the cost of your next visit is $200.

If your co-insurance is 20%, that means you will be responsible for $40 and your insurance plan will pay the remaining $160.

OUT-OF-POCKET MAXIMUM

The maximum amount of money you can pay for medical services over a certain period of time (usually per year). Once you meet your out-of-pocket maximum, your insurance plan will pay 100% of all allowed charges.

Example: Your insurance plan includes an out-of-pocket maximum of $4,000. You have met your $2,000 deductible and paid an additional $2,000 in co-pays and co-insurance. Your insurance will now pay 100% of any future necessary and allowed medical charges until your policy renews the following year.

SELF PAY

Patients who are not covered under a Healthcare Plan or choose to not use their insurance coverage for an exam can self pay.

ALLOWABLE VS. BILLED CHARGES

The allowable charge is the price that your insurance company will pay a medical provider (in this case SMIL/SDI) for a particular medical service. The allowable amount then also determines how much you pay in co-insurance. The billed charge is usually higher than the allowable charge and the difference is sometimes referred to as an adjustment. You pay a portion of the total allowed amount in the form of a co-payment, co-insurance, or deductible. Your health insurer pays what's left. Whether the provider is in-network or out-of-network with the insurance company determines who is responsible for the difference between the allowable and the billed amounts. An out-of-network provider can charge you that balance and it can be a significant amount.

IN-NETWORK VS. OUT-OF-NETWORK PROVIDERS

In-network providers are medical providers that have agreed to offer your insurance company discounted rates for medical services. They are also called "preferred providers". These specially negotiated rates typically mean you will pay less by going to an in-network provider. An out-of-network provider can also ask you to make up the difference between the amount allowed by insurance and the amount the provider chooses to bill.

PRIOR AUTHORIZATION

(pre-authorization or pre-certification)

Some medical procedures, imaging exams and medications require your insurance company's approval beforehand, called prior authorization. If prior authorization is required, but not obtained, your insurance plan may determine it will not cover the cost. Even receiving prior authorization is not always a guarantee that the cost will be covered. To be sure you're covered always contact your insurance before moving forward with a treatment or procedure. Your deductible, co-payments and co-insurance would still need to be met.

Examples

Jane's insurance plan has a $1,500 deductible.

The co-insurance is 20% with an out-of-pocket limit of $5,000.

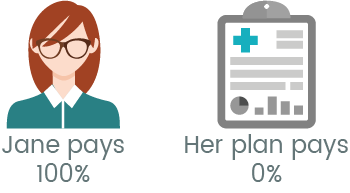

If Jane's office visit cost is $125 and she has not reached her $1,500 deductible, then she pays $125. Her plan pays no coverage.

If Jane has reached her $1,500 deductible, co-insurance begins. If her office visit is $125 now she only pays $25 and her plan pays $100.

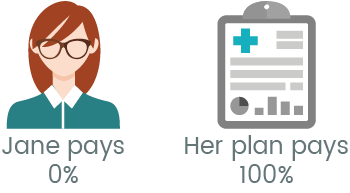

If Jane has reached her $5,000 Out-of-Pocket limit and has an office visit of $125 she pays nothing. Her plan pays her covered health care services all year.